Many commentators in the digital assets space dismissed the notion of a stable algorithmic stablecoin following the Terra/UST collapse earlier this year. Frax Finance is taking a novel approach that may cause many to revisit their thinking on whether that stability is possible where algorithmic stablecoins are concerned.

What is FRAX?

Frax Finance has developed the Frax protocol, together with the FRAX token. Frax is the world’s first fractional algorithmic stablecoin and it’s gaining popularity at a time when confidence in the integrity of algorithmic stablecoins is lower than it’s ever been.

Initially deployed on Ethereum, Frax is a multi-chain protocol that can be bridged for use on 12 other chains including Solana, Fantom, Avalanche, BSC and Polygon.

Frax doesn’t just claim to solve for the deficiencies associated with purely algorithmic stablecoins. It tackles deficiencies related to other stablecoin categories also.

Frax tokenomics

The protocol implicates 2 tokens:

The FRAX token acting as the USD stablecoin of the protocol.

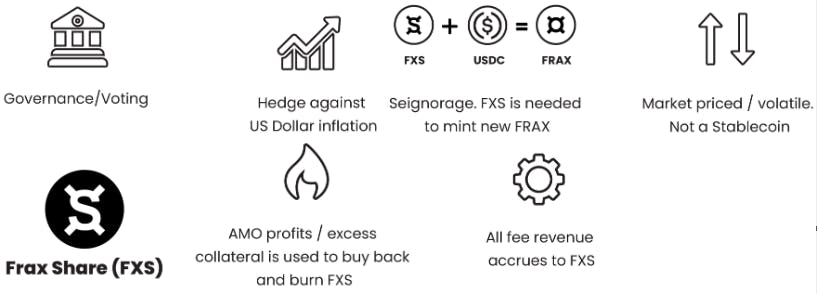

The Frax Share FXS token, the protocol’s utility and governance token.

Governance is minimized in line with the Bitcoin approach to governance rather than the active management approach pursued by MakerDAO. The thinking behind this approach is that the fewer parameters set for the community to manage, the less opportunity there is for disagreement to arise.

The FXS token was capped with a total supply of 100 million. Token distribution involves a 5% allocation to treasury and 35% to the project team and investors, with the remainder accounted for in farming rewards.

Fees and seigniorage revenue accrue to the FXS token. Profits from automated trading that is deployed within the protocol will facilitate buy-back and burning of FXS tokens. The FXS token supply will also become deflationary as demand for FRAX grows given that FRAX is minted at higher FXS ratios.

Maintaining the peg

The protocol’s stability mechanism is the part of the Frax stablecoin design which maintains the peg of 1 FRAX equaling 1 USD. For the most part, this is achieved through arbitrage.

Market participants take advantage of risk free arbitrage trades which contribute directly to the FRAX token maintaining its USD peg. Here’s how that breaks down: In the event of 1 FRAX having a value greater than 1 USD, anyone can take it upon themselves to mint 1 FRAX using 1 USD. That market participant then pockets the difference for themselves once they sell that FRAX on the open market.

Conversely, if 1 FRAX is worth less than 1 USD at any stage, that 1 FRAX can be redeemed directly to the Frax protocol for 1 USD. Again, there’s a financial incentive for the trader to act and pocket the difference.

Minting and redemption

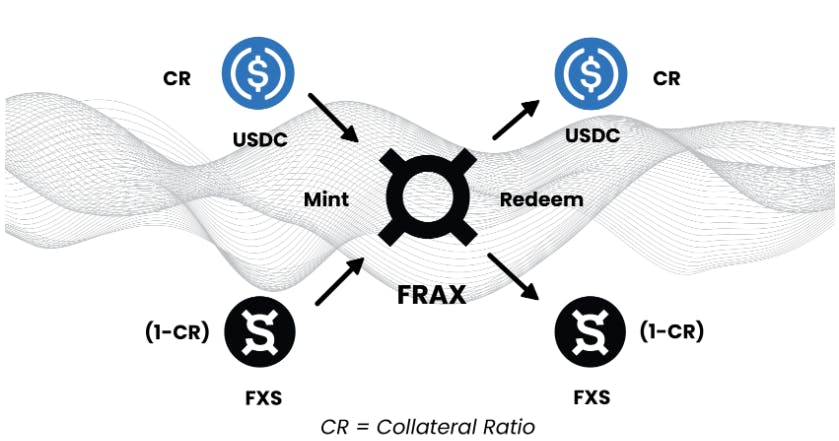

To mint 1 new FRAX token, the user must place 1 USD worth of value into the system. FRAX started out as 100% collateral-backed. The idea is that as confidence in the protocol increases, the collateral ratio can be reduced. That collateral backing is mainly in the form of USDC and FXS tokens. At the time of writing, FRAX had a collateral ratio of 89%.

Minting and redeeming FRAX tokens : IMG SRC

The collateral ratio

The current state of the protocol determines the ratio of collateral held as opposed to the degree of algorithmic backing.

The protocol adjusts the collateral ratio during times of FRAX expansion and retraction. When there’s greater demand for the FRAX token, the collateral ratio decreases. At other times when there’s less demand for the FRAX token, the collateral ratio increases.

The PID Controller within the FRAX protocol determines the collateral ratio. It relies upon a growth ratio relative to FRAX and FXS to assess market conditions and the liquidity available in the markets. With the establishment of this feedback loop, the collateral level adjusts itself continually.

Efficient use of capital via AMO modules

Frax Finance has found a way for the protocol’s FRAX stablecoin to maintain stability while being capital-efficient and putting deposited user funds to work. Algorithmic market operations (AMO) modules are key in achieving this. An AMO module is an autonomous contract that can arbitrarily enact monetary policy so long as that activity doesn’t take the FRAX token off its USD peg. AMO modules perform open market operations algorithmically.

The use of AMOs means that collateral does not stay in the collateral vault. The mechanism mimics the operation of commercial banks in TradFi — fractionally reserving a proportion of users deposits in the treasury but deploying the rest. The following AMOs are instrumental in aiding the protocol to achieve a profit:

Liquidity AMOs: A proportion of USDC collateral is used to mint new FRAX tokens. Some USDC collateral alongside FRAX tokens are then used to create liquidity for FRAX pools such as Uniswap, Curve Finance and Fraxswap. In these pools, the tokens accumulate transaction fees and other rewards.

Investor AMOs: USDC collateral is deposited into various DeFi protocols with the objective of accruing profits.

Lending AMOs: A proportion of USDC collateral is used to mint new FRAX tokens. In turn, those FRAX tokens are deposited into lending protocols where they earn borrowing fees and other rewards.

In addition to achieving a yield, AMO modules can also assist in protecting the FRAX USD peg. A collateral hedge AMO controller takes a short position against collateral held to minimize potential drops in collateral price. This AMO enables the protocol to be backed by more volatile collateral which opens up the potential to extend the range of collateral assets beyond USDC.

AMOs provide Frax with a lot of flexibility. Its users can propose any AMO strategy and if it is deemed to be a net positive for the ecosystem, it can be adopted.

Overcoming common stablecoin weaknesses

If we consider some well recognized faults with all the various stablecoins currently on the market, FRAX presents several advantages. Let’s start by considering the original leading stablecoins, Tether’s USDT and Centre’s USDC. At the time of writing, they account for 70% of total stablecoin market capitalization.

The first issue with them is that centralized systems are the opposite of what the cryptocurrency movement has been trying to achieve. It’s a major risk factor that will always hang over such a stablecoin. Any centralized entity that offers a collateralized stablecoin can come under pressure from a government to act as directed.

By contrast, FRAX is decentralized. In its current state, there is a centralized point of failure through its reliance on USDC as collateral. However, the aspiration is that over time the proportion of USDC backing will be reduced in favour of the algorithmic stablility mechanism. Furthermore, the project aspires to utilize more volatile assets like Ethereum and wrapped BTC in the future.

In addition to being centralized, both USDT and USDC are collateralized stablecoins. That also leaves market participants with an uncertainty over the integrity of the collateral backing. Tether’s USDT provides a stand out example. For years, the project has been steeped in controversy with perennial claims that it doesn’t have the collateral to meet the token issuance.

It is beside the point that these claims to date have not been borne out. The reality remains that even if it has been managed correctly, the potential will always exist that it simply isn’t backed 1:1, whether that be through incompetence, mismanagement or fraud. A stablecoin enveloped in a decentralized protocol like FRAX doesn’t present with this concern.

MakerDAOs decentralized DAI stablecoin is closer in nature to that of FRAX. It too relies heavily on USDC as collateral. As it doesn’t have an algorithmic stabilization element to it as FRAX does, it is designed to be overcollateralized. This means that it is very much capital inefficient comparatively.

Purely algorithmic stablecoins have proven to be difficult to bootstrap and slow to grow — while tending to suffer from extreme periods of volatility which erodes confidence in their utility. The standout example is of course the spectacular collapse of Terra/UST.

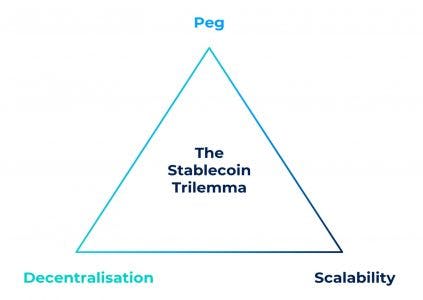

With these problems being widely acknowledged, most approaches to stablecoin design have exclusively embraced one design spectrum. Taking all of these shortcomings into consideration, the goal of the Frax project has been to implement stablecoin design principles to achieve scalability, trustlessness and extreme stability — all components of ideologically pure on-chain money.

All of these issues relate to what has been termed ‘the stablecoin trilema’. That concept focuses on the importance of three fundamentals where stablecoins are concerned, namely scalability, decentralization and a robust design that can be relied upon to maintain the peg. All of the issues outlined above feed into those fundamentals in one way or another. It’s too early to say but it could be that FRAX has the winning approach.

Risks

When it comes to a consideration of endogenous risk, anyone that has spent even a short length of time exploring these decentralized protocols knows all too well that it’s quite difficult to account for risks relative to the design of a DeFi protocol. This account of FRAX is quite enthusiastic about the protocol and the over-arching Frax Finance project but not to the extent that it forgets the lessons of Terra/UST and other humbling experiences within DeFi.

The Frax project is ambitious and covers a lot of ground. We know that where there is more complexity in the inner workings of these protocols, that increases the likelihood that there are aspects of that design or the underlying codebase which could be exploited.

Having the protocol out in the wild for an extended period will probably serve as the best test to determine just how robust it is.

US lawmakers are also providing another solid reason as to why it may not be wise to become a fervent FRAX-imalist just yet. According to a draft obtained by Bloomberg, as a knee-jerk reaction to the Terra/UST collapse, US lawmakers are seeking to target “endogenously collateralized stablecoins” with a 2 year ban. If enacted, the House Stablecoin Bill would put decentralized stablecoins like FRAX and DAI in the firing line.

Even if decentralized, the project is still in its infancy and needs the developmental support of Frax Finance. Such a ban would also retard adoption even if the project established more utility outside of the US.

Further innovation

Despite such challenges, the project continues to build momentum. Frax Finance’s efforts extend beyond the FRAX stablecoin. The project also features Fraxlend, a platform that allows any market participant to create a market pair between two ERC-20 tokens.

The permissionless lending market launched in September. The native borrowing and lending market will create more revenue which Frax will utilize to buy back and burn its FXS governance token.

In October, Frax launched Frax Ether, a liquid Ethereum staking system. It offers an advantage over Lido Finance, the leader in the Ethereum liquid staking derivative market. Frax’s staked Ethereum token is natively supported by DeFi protocols whereas Lido’s is not.

The protocol is achieving the DeFi holy trinity of services by offering a stablecoin, liquidity and lending services all on the one platform. With this innovation comes a lot of complexity. Remaining mindful of that and the risks associated with it, it’s a project that’s breaking new ground which is certainly worthy of your attention as it develops.