As the dust settles on ‘the merge’ - Ethereum’s major blockchain upgrade - it’s an apt time to take a look at how it played out and what the initial outcomes have been.

Successful execution

From a technical standpoint, Ethereum’s largest protocol upgrade to date was an incredible achievement. The culmination of countless hours of work carried out by hundreds of people over a number of years, it had been subject to several delays along its timeline.

Skeptics - of which there were many - confidently declared that it simply couldn’t be done. To attempt such a thing on a network that didn’t hold much in the way of value wouldn’t be all that noteworthy. However, to do so on a live network holding upwards of 160 billion USD in value is remarkable. Some had likened it to having to swap out the engine of a car while the car is still in motion.

It wasn’t just skeptics who were surprised with the seamlessness of the outcome. In a recent interview, Ethereum co-founder Vitalik Buterin stated: “The whole transition has happened even more smoothly than pretty much everyone - including myself - expected”.

Business as usual

As is par for the course in crypto, there was an excessive amount of hype surrounding the merge. With that hype came the development of misconceptions in the minds of many in regard to what the ultimate outcome would be.

Marketing 101 with Chipotle’s ‘Proof of steak': IMG SRC

Marketing 101 with Chipotle’s ‘Proof of steak': IMG SRC

Successful execution of this project certainly is a confidence booster, but it is only the first in a series of planned upgrades needed in order for Ethereum to fulfill its potential. The merge hasn’t fixed network congestion or high network fees.

As crypto investor and analyst Miles Deutscher reminded us some weeks prior to the merge, it is the first of five major protocol upgrades on the road towards an Ethereum scalability level of 100,000 transactions per second.

Next up comes the ‘surge’, followed by the ‘verge’, ‘purge’ and ‘splurge’. That next phase is timetabled for 2023, but bear in mind that previous experience demonstrates that delays are likely.

At an Ethereum conference in Paris in July, Buterin had also acknowledged that Ethereum would remain a work in progress post-merge. At the time he estimated that the project would be 55% complete once the merge had been accomplished.

Buy the rumor, sell the news!

In tandem with the merge hype, from a markets perspective, it was very much a case of ‘buy the rumor, sell the news’. From June onwards, Ethereum continued to consistently make unit price gains. The price peaked a couple of days before the merge was implemented, before tapering off over the course of the days that followed.

‘Sell the news’ events are nothing new in crypto. That said, the merge may go down in history as one of the most classic examples, given the multi-year lead into the upgrade and the level of anticipation associated with it.

Show me the (institutional) money!

It’s practically a cliché in crypto at this point but the claim that ‘the institutions are coming’ has long been anticipated and has never materialized to any substantive degree.

In the lead up to the merge, many in the Ethereum community had talked in terms of the likelihood of an immediate bail-in by institutions into ETH post-merge on the basis that they would be attracted by the yield on offer. With the move to proof of stake comes the opportunity to stake Ethereum tokens for an ongoing period to secure the network. As a reward for staking, users receive a yield of around 5%.

That hasn’t transpired in the first couple of weeks post-merge. The macro-economic environment had been challenging leading up to the protocol upgrade. The Dow Jones Index suffered its worst day since panicked pandemic conditions in 2020. Following the upgrade, we’ve seen continued fear in equity markets and on top of that, FX and bond markets have been thrown into chaos.

Additionally, the Ethereum community may have forgotten that institutions move slowly, cautiously and conservatively. In tandem with adverse market conditions, statements from regulators in the immediate aftermath of the merge may have spooked them.

Regulatory worries

Just a coincidence or deliberately timed? On the very day that Ethereum moved to a proof of stake based consensus mechanism, comments from SEC Chair Gary Gensler appeared in the Wall Street Journal that seemed to be relevant to Ethereum (although he said he wasn’t referring to any specific digital asset) .

He claimed that any crypto that implicated staking (which Ethereum now does post-merge) could be deemed a security on the basis that investors had the expectation of a return based on the work of a third party.

Any hint of the Ethereum Foundation, the Ethereum core dev. team or co-founder Vitalik Buterin being hauled over the coals in the courts for offering unregistered securities (as has happened with Ripple) would send any potential institutional investor running for the hills.

As a result of actions taken by the SEC against certain crypto projects in the last couple of years, many of the project originators have tried to distance themselves from crypto projects. But the issue is how can the guardians of the Ethereum project distance themselves from the project when Buterin believes it to be just 55% complete at this point?

This issue has many wondering if bitcoin’s Satoshi vanishing without trace means he/she had securities law in mind, making him a genius or whether that’s just coincidental.

Centralization concern

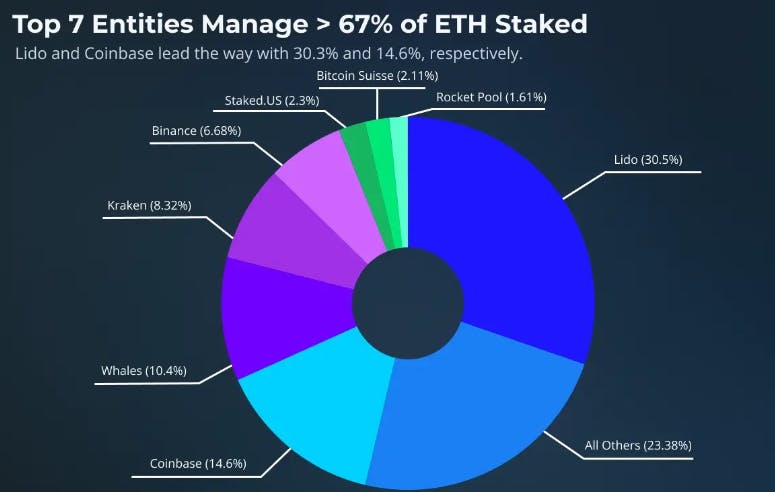

Ethereum’s move to proof of stake has also brought up concerns in terms of the centralization of staking. Rather than stake directly, users can delegate their coins to services like Coinbase, Lido Finance and Kraken. Of the first 1000 blocks validated after the merge, 420 of those were validated by Coinbase and Lido Finance.

With the Tornado Cash saga fresh in the minds of those in the crypto space, that concern may not be misplaced. Former Ethereum co-founder Charles Hoskinson, who later went on to found rival project Cardano, drew attention to the fact that 42% of the blocks are held by two centralized entities, indefinitely locked in proof of stake.

ETH staking breakdown : IMG SRC

ETH staking breakdown : IMG SRC

Critics are claiming that the merge has steered Ethereum towards greater efficiency at the cost of decentralization. On the other hand, defenders of the project claim that the proof of work-based system it left behind was more centralized due to the centralizing effect of the economy of scale associated with mining.

Ethereum sprouts green credentials

Alongside bitcoin, Ethereum has shipped widespread criticism for its massive energy use. The network’s electricity use is now minimal, having been reduced by 99%. Following the implementation of the merge on September 15, global electricity consumption was reduced by 0.2% in one foul swoop.

Non-fungible tokens (NFTs) hit new levels of popularity in 2021. The development brought many new users into the digital assets space who up until that point had shown little interest in cryptocurrency. However, many prospective users shunned the notion on the basis that Ethereum-based NFTs came with an outsized carbon footprint. With the merge, that objection goes away.

It has been argued that this development alone could lead to a new wave of adoption.

Improved monetary policy

The merge has resulted in a number of supply shocks for Ethereum that could work out favorably for token holders. On a mining-based system, miners would sell off a couple of billion dollars worth of Ethereum each month to cover operating costs. That sales pressure has disappeared with the move to proof of stake.

At the time of writing, staking itself takes 12% of Ethereum token volume off the market. There’s every reason to believe that the proportion of staked ETH increases going forward, driving the circulating supply down further.

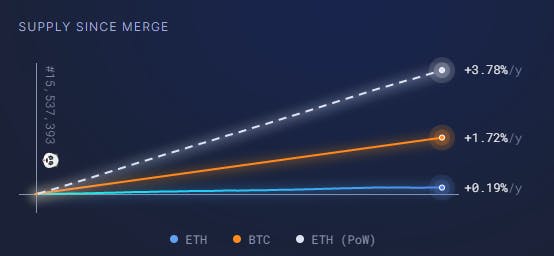

As the Ethereum network gets used more, more ETH will be burned in transaction fees, reducing circulating supply yet again. Overall ETH issuance has been reduced as the chart below demonstrates.

All of these changes point to tokenomics which could lead to Ethereum becoming deflationary. It all feeds into the digital asset performing better over time as reduced supply set against potentially rising demand is going to apply upward pressure on the Ethereum token price.

Negligible inflation rate on Ethereum post-merge : IMG SRC

Positive outlook

While we’ve identified a couple of issues in terms of regulatory concerns and possible centralization, so long as the project can navigate its way through these issues and continue onwards with its planned development, the outlook for Ethereum coming out of the merge is largely positive.

Although institutional investment hasn’t happened immediately following the merge, it doesn’t mean to say that it won’t as we move forward. The institutions need regulatory clarity. If they get it, then there’s every likelihood that Ethereum will be on their list of assets to gain exposure to.

Investing in line with Environmental, Social and Governance (ESG) policy is a big deal for corporate investors. Ethereum’s green transformation will no doubt make the project much more attractive to the institutions on that basis.

One of the key metrics for any digital asset project is the credibility of the development team. There’s a lot of work to be done still but on the basis of what was accomplished with the merge, there’s going to be a lot more confidence that the Ethereum project can be developed to a point where it can truly deliver on the potential so many believe it to have.