Ethereum, the most popular smart contract blockchain, can be slow and expensive to use. While upgrades are on the way to speed things up, a host of other networks have asked: why wait?

One such network is Polygon, a “layer-2” network that helps scale the Ethereum blockchain. That means that it sits atop Ethereum but processes transactions faster and cheaper, then feeds back transaction information to Ethereum.

Polygon has since advanced to become a suite of scaling solutions, plus an independent network capable of standing on its own two feet.

This network can process up to 65,000 transactions a second for under a penny each – by contrast, Ethereum processes just 14 transactions per second, as of August 2022, and each can cost well over a dollar – and sometimes over $100!

And while Polygon remains focused on Ethereum, it’s building a framework to capture the “multi-chain future” – the hypothesis that the future home of crypto will be spread across many blockchains rather than a single market leader, like Ethereum.

This article explains what Polygon is, how its coin, MATIC, works, and which protocols support it.

From MATIC to Polygon

Polygon was founded in 2017 as the creation of a talented group of Ethereum developers: Anurag Arjun, Jaynti Kanani and Sandeep Nailwal. They set up an Indian technology company called Polygon Technology to build the network. Their creation launched as a single layer 2 chain in June 2020 under the name of Matic Network.

After it became clear that Ethereum couldn’t be serviced by a single layer 2 network, the team began to expand its offering. In February 2021, the Matic Network rebranded Polygon to reflect the project’s shift to focus on building a suite of Ethereum scalability solutions.

Upon rebranding, the team added Mihailo Bjelic as a fourth co-founder. The coin’s ticker, MATIC, still reflects the project’s original name. Now, things are coordinated by a non-profit called the Polygon Foundation.

You might have heard of MATIC before – it’s been in the (crypto) news because of its rising price. It was worth less than a penny until the start of 2021, around the time of the rebrand.

Then it soared in price, first to $2.45 in May 2021 and then again to $2.87 in December 2021. At its December peak, MATIC held a market cap of $20.41 billion – before crashing to $3 billion by June 2022, along with the wider crypto market.

MATIC’s spurt to the top, albeit short-lived, showed that there’s a lot of demand for a high-speed, low-cost blockchain. In 2021, rising prices for other similar blockchains, like Solana and Avalanche, showed that there’s competition, too.

The Polygon network is now very well funded, having sourced $451 million in investments as of August 2022. A single venture round in February 2022, led by Sequoia Capital India and joined by 39 other investors, including Variant Fund and Union Square Ventures, comprised $450 million of its total funding.

How Polygon’s PoS chain works

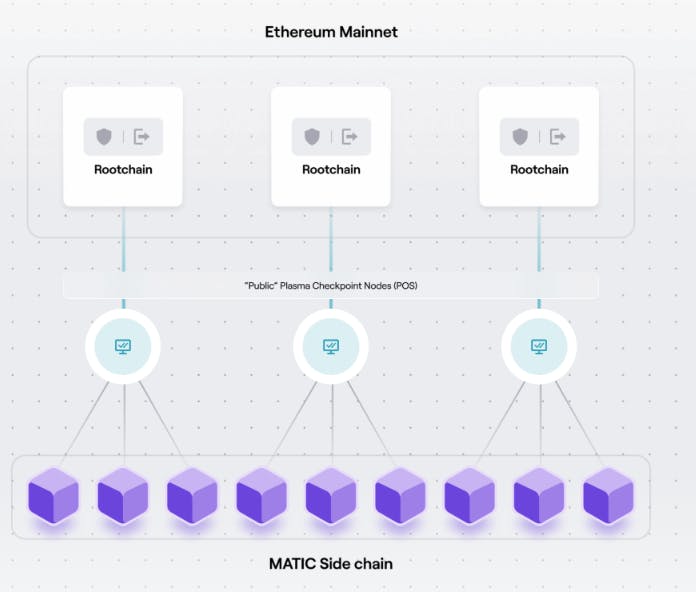

Polygon achieves most of its scaling through a proof-of-stake sidechain – this is the technology that went live in the original Matic Network.

Proof-of-stake chains are those that let those who have locked up the most coins, rather than those with the beefiest computers, validate transactions. Sidechains are networks that feed data back to a parent blockchain, in this case, Ethereum.

Polygon’s sidechain claims transaction speeds of up to 65,000 transactions per second. How come it’s so much faster than Ethereum? It’s all thanks to something called “More Viable Plasma”, a scaling solution that removes the need for confirmation signatures (thereby speeding up) on Plasma, a framework for a network of child blockchains that feed data back to Ethereum.

Each of these child blockchains, which run parallel to Ethereum, is essentially a copy of the Ethereum blockchain – but one that operates at several hundred times the speed. Every so often, Polygon’s validators record all the activity on these plasma chains and submit their data to Ethereum.

This means that if Polygon’s child chains should go awry, it’s possible to get your crypto back from the child chain. Polygon prevents validators from manipulating these snapshots by requiring them to stake MATIC tokens – i.e. to lock them up on the Ethereum blockchain. If validators try and manipulate their snapshots, some of these staked MATIC tokens are destroyed.

Polygon’s PoS network structures this work into three layers. The first is the Ethereum layer, on which MATIC is staked. The second is Heimdall and the third is Bor. Heimdall is responsible for coordinating the selection of (and updating) validators and taking snapshots of the child chains. The Bor layer is responsible for shuffling transactions into blocks. The 7-10 validators that complete the work on Bor are chosen at random from the 100 validators that operate on Heimdall.

Polygon allows any web3 project to launch a dedicated version of Ethereum that relies on these fast and cheap proof-of-stake child chains. Their smart contracts run in the Ethereum Virtual Machine, virtual instances of Ethereum that abide by its computational logic.

Polygon’s PoS chain allows for a degree of flexibility in how web3 projects operate on the network. All Polygon chains can speak to other Polygon chains and also to Ethereum.

These chains can, however, be independent of Ethereum – even though they ultimately feed data back to Ethereum, standalone chains can have their own pool of validators. Alternatively, they can validate transactions through “secured” chains, whereby Ethereum validators, or a pool of professional validators, confirm transactions.

Polygon’s other scaling solutions

Polygon’s proof of stake chain is just one of the scaling solutions the network offered. But what else is in its toolkit?

It’s clear that Polygon considers the future to be in zero-knowledge proof rollups. In August 2021, Polygon committed $1 billion to develop the technology, which rollups up lots of transactions into a single one, then feeds the transaction back to a more powerful chain, like Ethereum.

Polygon is betting on zero-knowledge proofs, which only publish the date and time of a transaction, being the future rather than optimistic rollups, which “optimistically” assume that all transactions are valid. Still, “optimistic rollups have the advantage of being ready now,” wrote Brendan Farmer of Polygon in the January post.

That’s why one of Polygon’s solutions, a collaboration with Big 4 professional services firm EY, Nightfall, is a mix of both optimistic and zero-knowledge rollups. It’s the only rollup that’s live so far on Polygon– and even then, it's in beta. Also in the works is Polygon Zero, a true zero-knowledge rollup, and Miden, another EVM-compatible rollup.

Polygon is also working on Polygon zkEVM, an open-source zk-rollup that provides the equivalence of the Ethereum Virtual Machine, plus the security of Ethereum, and Polygon Avail, a modular blockchain that collates transaction data from other blockchains. But even Polygon Avail, which doesn’t rely on any of these fancy rollup technologies, remains in testnet.

The only other thing live as of August 2022 is Polygon Edge, “a modular and extensible framework for building private or public Ethereum-compatible blockchain networks.”

What can you do with Polygon?

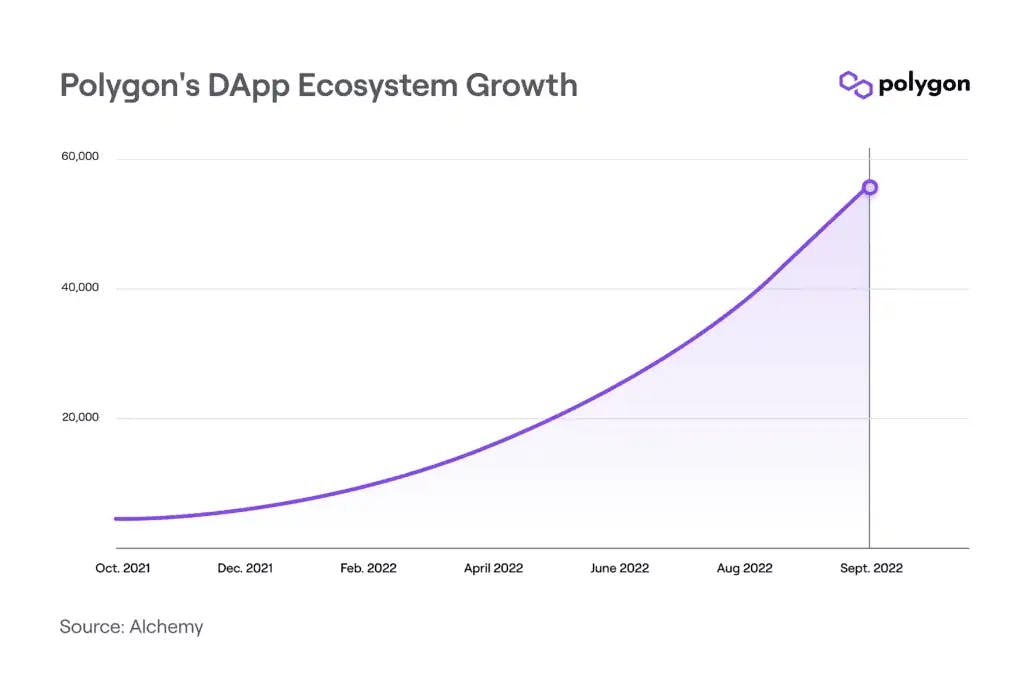

All this tech is well and good, but what can you actually do with Polygon? Thankfully, quite a lot. According to DeFi Llama, Polygon has $2 billion in total value locked up on the network, as of August 2022.

About 22% of this, or $446 million, is in decentralized lending protocol Aave, which started to use Polygon in its V2 version to cut costs and sped things up. When Aave launched the third iteration of its lending protocol, v3, it deployed the entire thing on scaling solutions, including Polygon.

Uniswap, the largest decentralized exchange on Ethereum, supports Polygon (alongside rival scaling solutions Optimism and Arbitrum), meaning that traders can rely on the network to process cheap transactions.

About $82 million is locked up in the Polygon version of Uniswap. While sizeable, that’s small potatoes considering Uniswap’s total TVL of $6.24 billion, of which $6 billion sits on Ethereum.

The largest decentralized exchange on Polygon is Quickswap, which supports $359 million in TVL. But lots of big names from Ethereum have also set up shop on Polygon, including Curve, Sushi, Balancer and PoolTogether.

To use all of these, you’ll need to use MATIC, the platform’s gas token. It’s the equivalent of using ETH to pay for Ethereum’s transaction fees. As of August 2022, average gas fees are about $0.003, or well above Ethereum's average gas fee of $0.8, as of this writing.

Whether Polygon remains an important scaling solution depends on the future of Ethereum. The network, still the largest one that supports smart contracts, massively changed in September 2022 after it merged to proof-of-stake – the same technology that powers Polygon’s chain. After, Ethereum will eventually add plasma chains, similar to how Polygon works.

However, it’s still too early to determine whether Ethereum co-founder Vitalik Buterin was right when he said that scaling solutions will continue to complement Ethereum, rather than being cast by the wayside after Ethereum upgrades its protocol.