Ethereum’s market capitalization peaked at about $569 billion in May 2021. But despite its immense popularity and high value – it’s the second largest network after Bitcoin – the blockchain could be slow and expensive to use. Transactions took minutes to go through.

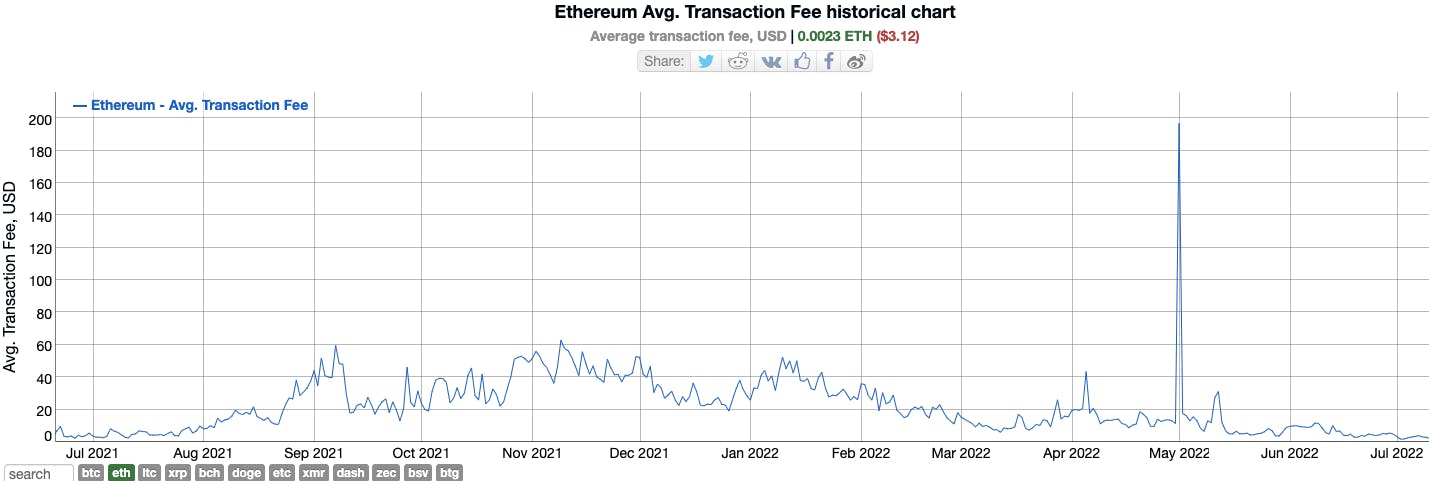

When the network becomes congested, it could cost upward of $100 to execute a single transaction. Making matters worse was Ethereum’s environmental footprint. Make claims about hydroelectric mining farms and flared gas operations all you like, but proof-of-work was an energy-intensive process and ceased at nothing in its quest for limitless expansion.

At the same time, people really liked Ethereum; the blockchain was the first to support smart contracts and had not been knocked from its top spot by any of its rivals, such as Solana or Avalanche (although several have become close, albeit usually briefly).

The Ethereum network supported the DeFi boom of 2020, which introduced to the world a panoply of decentralized financial protocols, such as Uniswap and Compound, and a burgeoning NFT market that captured the spirit of the moment – admittedly, financial excess.

So, rather than jumping ship to a newer, faster model, the community backed Ethereum’s largest change yet. In September 2022, Ethereum transitioned from a proof-of-work chain to a proof-of-stake chain.

The transition is known as “The Merge”, and laid the groundwork for fixing the problems that slow down the beleaguered blockchain, while instantly making it 99% more energy efficient. This article clarifies why it happened and what should follow.

The Merge

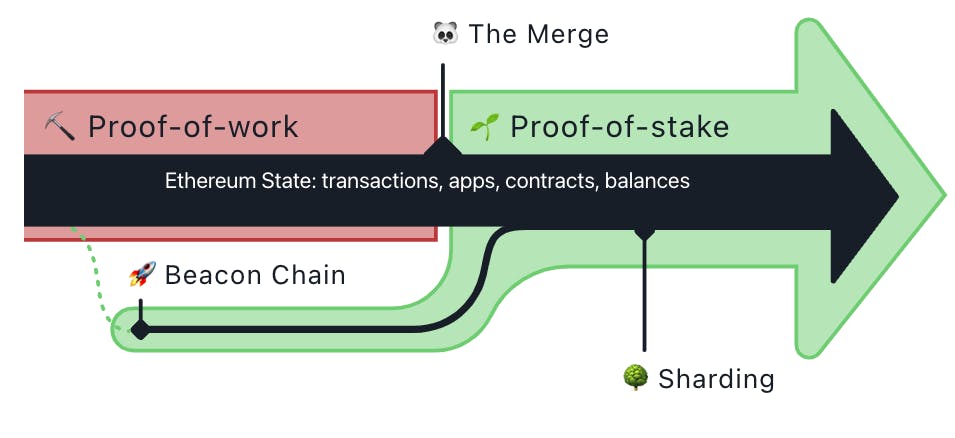

On a technical level, The Merge referred to the union of the “Beacon Chain”, a standalone Ethereum proof-of-stake node, with the Ethereum mainnet. The mainnet is the “official” version of the Ethereum blockchain. The Beacon Chain has been live since December 1, 2020, and supported just over 400,000 ETH-staking validators at the time of The Merge.

Pre-Merge, the Beacon Chain was a one-way system. It didn’t support smart contracts or peer-to-peer transactions. Until (shortly after) The Merge, all that ETH – 13.9 million of it ($23.5 billion, as of August 2022) – was pretty much stuck there, earning 4.2% of non-redeemable interest. (However, it was possible to trade derivative tokens that represent claims on staked ETH).

The main draw to The Merge was the proof-of-stake stuff. Proof-of-X refers to the mechanism by which blockchains validate transactions. Because they’re decentralized networks, where no single entity calls the shots, blockchains have to come up with a way to get other people to validate transactions.

The original method, first employed by Bitcoin and later many other networks, including Ethereum, was called proof-of-work. This mechanism convinced people to process transactions by having anonymous computers, known as miners, brute force their way to a random mathematical transaction.

The first computer to win the race and crack the code would receive a newly minted coin for their efforts, and the right to validate transactions in a block and add them to the immutable blockchain. The reasoning behind why these miners would bother to mine for bitcoin is somewhat circular – perhaps a decentralized network has value. And hey, look: it does!

Proof-of-work, often contracted to PoW, demands a lot of energy because all the computers have to run calculations until they hit a random magic number. That energy has to come from somewhere, and plenty of energy sources are not environmentally friendly. (Advocates will point you to the plethora of environmentally sustainable miners, but far more sustainable is to abstain from PoW chains altogether).

Proof-of-stake chains take the computationally intensive part of mining out of the equation. Instead of letting the beefiest computers mine for new coins, those who have locked up the most coins on the network are proportionately more likely to be awarded the right to mine blocks and earn those newly-minted coins. PoS also, arguably, decentralizes the network.

Mining equipment is expensive, as is a hefty electricity bill one has to pay in most parts of the world to power that miner. On the other hand, anyone can stake coins on Ethereum. You’ll need 32 ETH to become a validator but those without the coins can delegate their coins to a validator, who’ll return them a cut of the profits.

The mechanism of proof-of-stake isn’t perfect, either – while PoS is certainly easier on the environment, it means that the rich get richer, promoting inequality on the chain (and, given the value of Ethereum, in society at large, too).

However, as the Ethereum Foundation states, “The validator rewards are significantly less than the miner rewards issued on proof-of-work (2 ETH every ~13.5 seconds), as operating a validating node is not an economically intense activity and thus does not require or warrant as high a reward.”

After The Merge, you can’t mine Ethereum on the mainnet anymore – you can only continue mining ETH through an unpopular proof-of-work fork that miners are pushing (it remains unsupported by major Ethereum players, such as the issuers of the popular U.S. dollar stablecoin, USDC). This fork is analogous to Ethereum Classic versus ETH.

Merge Timeline

The Merge was a long time coming. Ethereum inventor Vitalik Buterin told Fortune in 2021 that the integration of proof-of-stake would take just a single year – not the seven it eventually took.

Things heated up after the launch of the Beacon Chain, and also the introduction of EIP-1559, which destroyed ETH paid in base fees instead of handing them to miners. The latter disincentivized miners and hastened the move to proof-of-stake.

In 2022, Ethereum tested the merge of the Beacon Chain and the mainnet several times, and then transitioned several testnets – test environments on which DeFi developers can try out their protocols with pretend ETH – to proof-of-stake. The Merge finally took place in September 2022, and went off without a hitch.

The Merge and Ethereum’s Tokenomics

One side effect of The Merge is that, when coupled with EIP-1559, Ethereum could become deflationary. That means that instead of producing more ETH over time (as is the case with Ethereum right now, and networks like Bitcoin), Ethereum could slowly reduce its supply over time.

That’s because The Merge reduced the daily issuance of new ETH by about 90%, from about 13,000 ETH (from mining) to 1,600 ETH (from staking). However, Ethereum would only become deflationary if it continues to grow in popularity.

As The Defiant reported, “demand for block space must increase by roughly one-third from current levels in order for the burn rate to keep pace with post-merge Ether issuance”. But transaction fees – a common indicator of demand – have fallen amid the bear market, and are at their lowest since April 2020, according to data from Ycharts.

Still, the reduction of new issuance is such that ETH will potentially become deflationary. To some traders, that’s similar to the Bitcoin halving, whereby issuance of new BTC halves every four years – and is commonly associated with a price rise (although cause and effect have not been determined). That’s led some traders to be bullish about The Merge’s effect on ETH’s price – even though ETH fell in the weeks that followed The Merge.

Ethereum upgrades after The Merge

The Merge was just the first in a series of Ethereum upgrades. These upgrades used to be called Ethereum 2.0 but The Ethereum Foundation decided to refer to them as Ethereum upgrades instead. The first major upgrade after The Merge is sharding.

This splits Ethereum into 64 chains, each capable of processing transactions simultaneously rather than working through each transaction chronologically, as is currently the case. The Merge was the necessary precondition for all of this to happen, as the Beacon Chain coordinates all of these chains. That’s scheduled to go live in 2023.

At a conference in France in July 2022, Buterin, Ethereum’s inventor, outlined what comes next: the “surge,” “verge,” “purge,” and “splurge”. The surge is the inclusion of sharding, as described above.

The verge implements stateless clients, plus a mathematical proof called “Verkle trees”, both of which lower the computational barriers to becoming Ethereum validators. The purge reduces the barriers of becoming a validator yet further by not requiring nodes to store the blockchain’s history. The “splurge” refers to “all of the other fun stuff,” said Buterin.

Combined, the upgrades will allow the network to scale. Buterin predicts that Ethereum could one day process more than 100,000 transactions per second, and that transaction fees could continue to drop.

Of course, the significance of all of these upgrades derives from Ethereum’s continued relevance. Lots of protocols are considering moving to rival blockchains, like Polygon, Solana and Avalanche.

Yuga Labs used the botched land sale for a Bored Ape Yacht Club metaverse, during which $158 million of ETH transaction fees were burned, to justify the development of a more efficient L1. While The Merge and subsequent Ethereum upgrades are certainly important for the future of web3, they may be overshadowed by advancements in other networks.