There’s a strange phenomenon popular with crypto protocols. People have devoted their lives to amassing decentralized assets in the hopes that they’ll one day become immensely wealthy when their tokens soar in value. Why then, do some protocols “burn” these tokens – remove them permanently from circulation – in the millions or billions, when their creators could just as easily hoard them and strike it rich themselves?

The explanation of this practice, known as buyback & burn, relates to a simple piece of economic theory: supply and demand. The less of something there is, the more that people want a piece of that which remains.

Supply and demand explains why you’ll jump at that slice of cake when it’s the last one left on the deli counter, and why you might even pay more for it. That function of economy psychology is precisely also why cryptocurrency protocols snap up their tokens from secondary markets, then burn them – to heighten demand for whatever’s left, and drive the price of the token.

What is burning?

On a technical level, burning refers to sending a token to a wallet that can only receive tokens. That means that these wallets, which are verifiably one way, can’t spend tokens; these tokens can be considered permanently removed from circulation.

Of course, you should double-check that tokens are indeed one-way. Shiba Inu considered tokens burned because they had been sent to the dusty wallet of Ethereum inventor Vitalik Buterin – then Buterin donated billions of dollars worth of the token to charities that alleviated the suffering endured by Indians during the coronavirus pandemic. The token crashed on the news.

How about buyback & burn?

Buyback & burn refers to a program that buys tokens from the open market, then sends them to these one-way wallets. Buyback & burns are similar in principle to a stock buyback – where a public company buys back its stock from the open market; its thinking is that by reducing the circulating supply of that stock, it increases demand for what remains in circulation.

It’s up to a project to work out how it scrapes together that money. But where do crypto networks get the money from? Most buyback & burn tokens burn profits.

FTX Token (FTT), the exchange token of crypto exchange FTX, buys FTT from its own exchange with a third of all the money the exchange makes through fees (apart from a handful of exceptions, including promotional discounts).

Then the exchange burns them. This ensures that the price of the token is artificially propped up by trading fees, and that the exchange always has money in the bank to buy these tokens.

Binance has long burned its exchange token, BNB. As of April 2022, it had burned about 1.8 million tokens, or the equivalent of (at April’s prices) about $742 million.

Binance used to devise the number of tokens it burned itself – it reflected usage and revenue on Binance, but it was unclear precisely how.

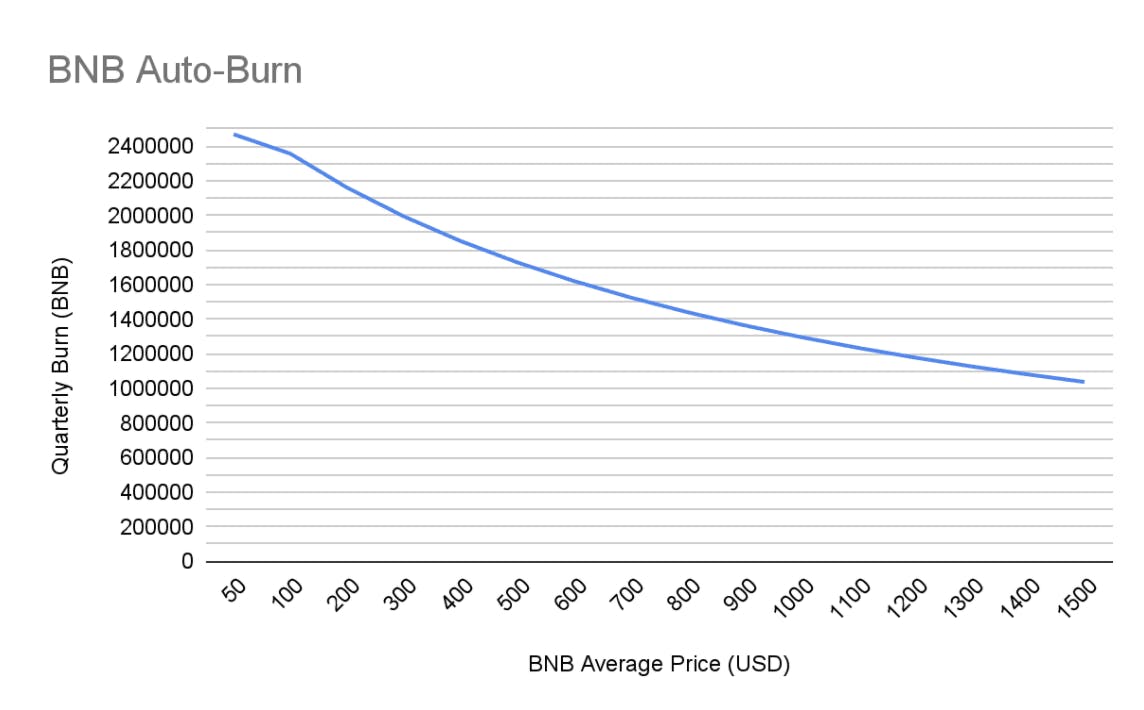

In the last quarter of 2021, Binance switched to an automatic burn system. Called auto-burn, it aimed to make its burns “objective and verifiable”. No longer would the burns be dependent on the success of Binance, but instead on the price of BNB, which Binance interprets as the supply and demand of the token.

Alpaca Finance adopted another type of buyback & burn mechanism: to use 4% of all liquidation fees to buy back ALPACA tokens, then burn them. About half of a borrower’s interest fees from the reserve pool are also burned.

It might seem strange for a company to burn tokens while simultaneously trying to drive the value of that token (often indirectly, through a decentralized community).

But a 2019 academic paper titled, “Tokenomics and Platform Finance” noted that the ideal situation is for the “entrepreneur” to simultaneously “extract token[s] as dividends”, for instance by scraping transaction fees to a community treasury. Thus, artificially driving the price of tokens while also earning dividends from the protocol “is an incentive-compatible rewarding scheme for the founding designer.”

Other deflationary mechanisms

Burning tokens is a deflationary piece of monetary policy. It reduces the number of tokens in supply. It can also be disinflationary – the number of new tokens the network produced could still outstrip those burned but the protocol’s tactics could make a huge dent in that growth.

But buying tokens is not a prerequisite to enacting a token burn. Sometimes, the protocol or founding team already owns the tokens. When the Nervos Network launched its coin, CKB, it immediately burned 25% of its initial supply of 33.6 billion – dramatically curtailing its supply. The network didn’t need to first buy these tokens.

That was at launch – in October 2019, Thorchain announced plans to burn half of the initial maximum supply through “use or burn”, a mechanism that burned tokens the community did not allocate elsewhere. These were tokens owned by the community – “use or burn” incentivized them to put their money to work, thereby driving the token’s value by adding utility or choose to let them burn tokens to artificially increase the price of the token by reducing its supply, and thus heightening demand for the remaining tokens.

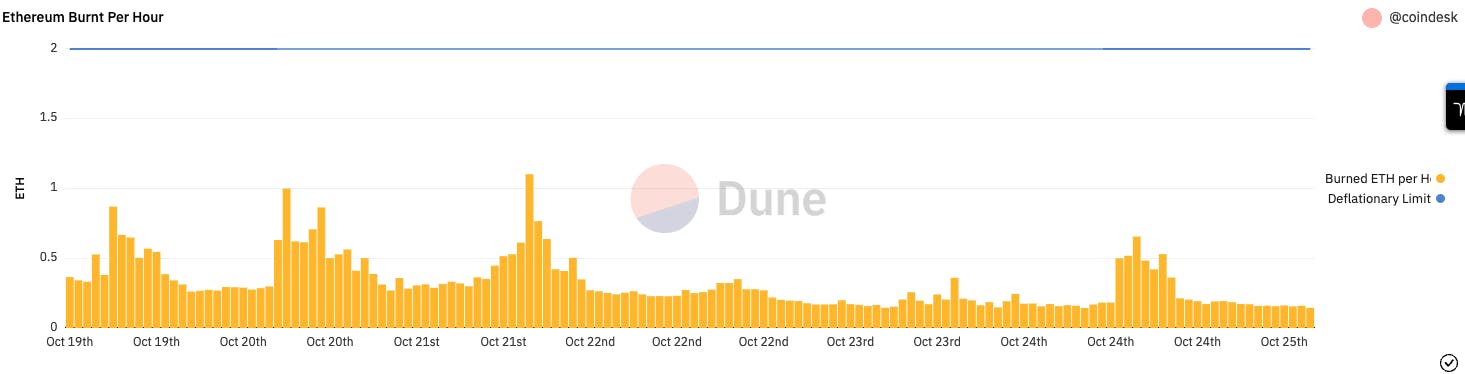

Ethereum took another route through EIP-1559, an Ethereum upgrade that burned tokens instead of giving them to miners. The idea was that, by burning tokens, the network would make gas fees more predictable. It would also incentivize miners to wind down their services ahead of the network’s switch to what was then known as Ethereum 2.0 – a suite of Ethereum upgrades that aim to help the network run faster.

EIP-1559, introduced in August 2021, didn’t make the network deflationary; the coins created by proof-of-work mining still outpaced the number of coins burned. But it did limit the growth of new coins. In its first year, EIP-1559 burned about 2.7 million ETH.

NFT projects can also burn tokens – occasionally, for artistic value, or to prove a point. An NFT collection called WZRDS decided to let NFT holders burn NFTs that had been listed for a low price. The idea was to punish NFT holders for “flipping” NFTs – selling them for a quick profit at slightly a slightly higher price than that for which they were bought.

Those whose NFTs had been burned following the introduction of the new mechanism received Half-Skull of Wizard NFTs. As of July 12, when trade publication The Defiant broke the story, these new NFTs sold for just 0.17 – the originals sold for 3.2 ETH.

And their corollary: Inflationary mechanisms

The opposite of buyback & burn is token inflation, whereby the number of tokens in public circulation increases over time. As the real world has handily pointed out, through the inflation of currencies like the US dollar and the euro, inflation reduces the purchasing power of an individual unit of currency.

But in crypto, inflation is necessary to keep decentralized actors, like miners, interested. That’s why, for instance, the Bitcoin protocol mints new coins each time miners produce the ‘blocks’ that comprise the Bitcoin blockchain.

This increases the supply of new Bitcoin but simultaneously motivates miners to process transactions. Of course, this hasn’t hurt the price of Bitcoin – the coin has risen from virtually $0 in early 2009 to highs of about $68,000 toward the end of 2021.

In other cases, a protocol’s community can vote to simply increase the maximum supply. That’s what happened with Yearn Finance, who in February 2021 voted to increase the supply of the decentralized finance protocol’s token, YFI, by 20%.

The expansion of the supply was designed to reward key contributors to the protocol; 33% was set aside for de facto employees and the rest went go toward a community treasury, according to reporting by CoinDesk.

Does buyback & burn work?

The argument in favor of buyback & burn is simple enough. Philipp Schulz, partner of INVAO group, described the myriad theoretical benefits in a 2019 blog post.

He said buyback & burn programs “support the growth and price stability of the token value once listed for secondary trading”, result in “increased liquidity”, “lower price volatility” and “incentivizes long-term growth investors to HODL the token, which further adds to the price stability of the asset.” Sounds great, but INVAO’s token, IVO, is literally worthless.

There isn’t much scholarship or analysis on whether buyback & burn is effective. That said, BNB, one of the largest cryptocurrencies used buyback & burn and became one of the top five largest cryptocurrencies in 2022. Of course, correlation is not correlation.

So how about stock buybacks, the closest analog? It’s difficult to say definitively whether they work, but it’s clear they’re huge business.

A Harvard Business Review report found that companies within the S&P 500 spent over half of their earnings, or $2.4 trillion, on buybacks between 2003 and 2012. Proponents say they help out shareholders by driving up the price, although those against the idea think that the money could be better spent on growth than artificially driving up the price.